MaxCyte (NASDAQ:MXCT, LON:MXCT): unsexy genes

An unloved stock and non-viral substitution competitor to Oxford BioMedica (LON:OXB) in the ex-vivo CGT market

Please bear in mind when reading this post that I own shares in Oxford BioMedica, a competitor to MaxCyte, which likely distorts my perspective. Also, the following content is for general information purposes only and is not advice. Please see the about page for my full disclosure policy.

I am not interested in owning MaxCyte. Firstly, it is in the process of delisting from AIM and will only be listed on the Nasdaq, and I only invest in UK and Australian listed stocks. Secondly, from my perspective, the company has no clear path to profitability in the short to medium term.

However, I am interested in the company given it indirectly competes with one of my holdings, Oxford BioMedica (LON:OXB). Also, like many healthcare stocks right now, it is pessimistically priced which might make it of interest to readers who are more comfortable with its unique risk profile.

MaxCyte is a 26 year old company which has developed a high throughput electroporation technology called Flow Electroporation®. Electroporation is a way of introducing molecules into a cell without damaging it by applying an electrical field to temporarily increase the permeability of the cell membrane. This is a useful technique for cell therapy which requires the introduction of new genetic material into a cell.

MaxCyte’s Flow Electroporation® enables the transfection of up to 20 billion cells in a single run, making it highly suitable for large-scale clinical and commercial manufacturing. Competing technologies from competitors Thermo Fisher and Lonza can only transfect 2.5 billion and 1 billion cells respectively, based on information from their product pages. This positions MaxCyte as the leading company in electroporation for commercial applications.

OXB is a contract manufacturer which makes various types of viruses to carry genetic material into cells. Viruses have evolved to carry out this task making them highly efficient, but somewhat dangerous and the process of manufacturing them is expensive.

Electroporation presents less risk to the patient and is potentially cheaper, but is confined to ex vivo applications. This typically involves drawing blood, changing the genes in the blood cells, and then infusing it into the patient and is how all currently approved CAR-T therapies are carried out, for example.

All currently approved CAR-T therapies are also done using viral vectors, but this seems likely to change with MaxCyte themselves currently working on promising candidates with the likes of CRISPR Therapeutics and Caribou Biosciences.

As you may have guessed, in vivo treatments involve changing cell genetics within the body. Really, for most cases aside from treating blood, it is not possible to use an ex vivo approach and it is therefore not possible to use electroporation. Also, in vivo treatments are usually more straightforward to administer from a clinical workflow perspective.

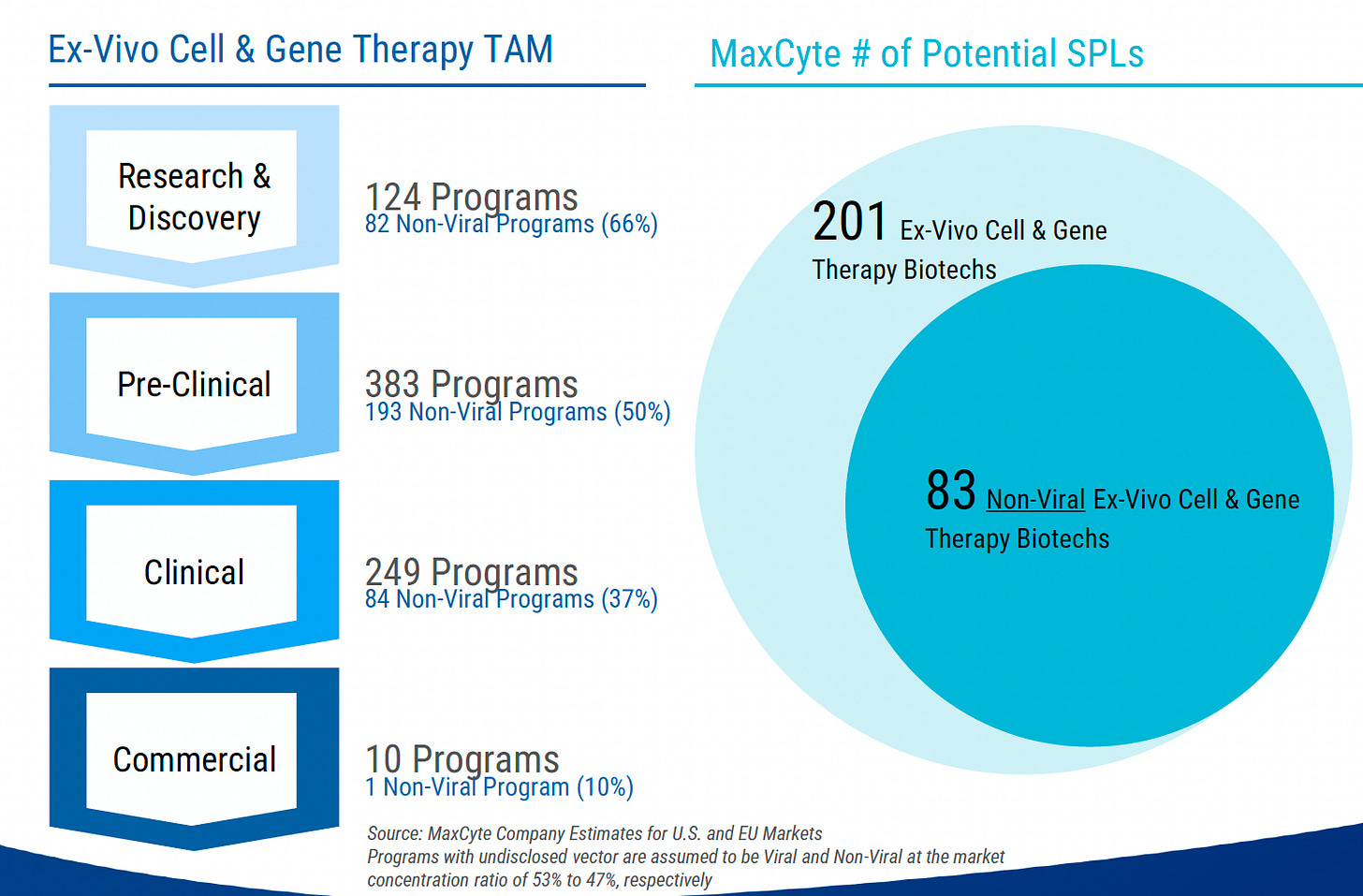

While the ratio is hard to pin down, from what I can tell, about two thirds of current cell and gene therapy (CGT) clinical trials are for in vivo therapies and one third are for ex vivo. But within ex vivo, it looks like OXB and other viral vector makers might see increasing competition from non-viral technologies.

Source: MaxCyte May 2025 Corporate Presentation

MaxCyte operates a dual business model. It sells machines and consumables to researchers and those involved in drug discovery. This part of the business has particularly struggled since interest rates rose in 2022. With less funding available, biotech companies have become more focused on progressing their most promising candidates to save money.

MaxCyte also offers Strategic Platform Licenses (SPLs) for clinical trial and commercial use. This is where customers lease rather than buy the instrument, still purchase consumables and also pay MaxCyte milestones and royalties as and when drugs progress through the clinic and into market.

The number of SPLs has grown from just eight at the end of 2019 to 29 today. One such deal is for CASGEVY, a drug approved to treat sickle cell disease and transfusion-dependent beta-thalassemia. The approval of CASGEVY resulted in a bumper year for SPL program related payments of $11.5 million for MaxCyte in 2023.

The total maximum value of future SPL program related payments is in excess of $2 billion according to the company across its 29 active agreements. Of these, 18 are currently in clinical development and all of these are at phase 1 or phase 2. As we all know, failure rates in clinical trials are high so let’s heavily discount the total SPL program value by 90% to give $200 million. This assumption fits well with the early stage profile of the programs and the associated elevated risks and time lag.

In addition, the “core revenue” of the business (instrument sales, leasing, consumables) is tracking at about $36 million per year and expected to grow between 8% and 15% this year. This revenue generates gross margins of over 80% and applying a relatively conservative five times multiple gives us another $180 million of value.

The company has $175 million of cash, but is currently spending this at a rate of around $30 million per year. Let’s assume that most of this is spent getting to break-even and so attribute no value to it for valuation purposes. This is perhaps too pessimistic, but given the high level of uncertainty I think such prudence is warranted.

MaxCyte has a market capitalisation of ~$250 million at the time of writing, versus my guesstimated value of ~$380 million. One area of risk for MaxCyte which I haven’t touched upon is the strength of its intellectual property. If others can develop products which can replicate its high transfection rates, then it may not be able to continue charging royalties and licence fees in the future.

As I said, the lack of clarity over when MaxCyte will become profitable puts me off. In contrast, OXB is guiding to positive EBITDA this year with margins rising thereafter. It is also forecasting 24% to 32% revenue growth this year compared to core revenue growth of between 8% and 15% for MaxCyte. Further, while MaxCyte’s SPLs include just one commercial drug in CASGEVY and no others in late stage trials, OXB has two commercial and four late stage clinical programs.

OXB gross profit was £53 million in 2024 and it has a market capitalisation of £345 million. According to ShareScope, consensus estimates for 2027 EBITDA are £52 million. The CGT market is still in its infancy and so I anticipate further strong growth beyond then.

From what I can tell, electroporation is a serious (and possibly superior) alternative for some treatments such as CAR-T that currently rely on viral vectors. However, the technology is limited to ex vivo applications and the CGT market is growing rapidly into many disease areas. My guess is that there is space for both viral vectors and electroporation to thrive.

Source: OXB’s 2024 final results presentation