Selling GenusPlus Group Ltd (ASX:GNP) and buying Nanosonics Ltd (ASX:NAN)

I sold my shares in GenusPlus because I had 18% exposure to the green energy transition through holdings in ASX:EOL, ASX:SXE and ASX:GNP. This was more than I was comfortable with in light of the increasingly likely return of the Coalition to power this year. The Liberals have already laid out plans to build nuclear power stations rather than relying solely on renewables. Any slowdown in the pace of the renewables rollout is likely to hurt Genus given a large part of its business is building transmission and distribution infrastructure.

I’m not saying this will happen, but that the risk is increasing, my pre-existing exposure to green energy was too high, and I prefer my other two holdings in this space.

I prefer Energy One because it is a higher quality business with broader geographic exposure given over half of its revenues come from Europe.

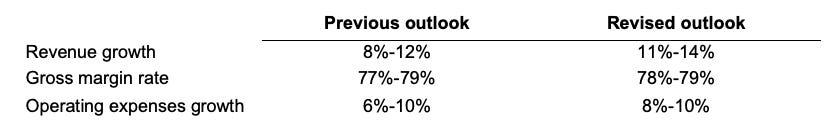

It also appears to have just hit an inflection point giving management the confidence to put out the following guidance:

The shares are expensive with a forward PE ratio in the mid 30s according to Stockopedia, but this high rating is more than justified by the business trajectory in my view. Furthermore, due to the increasing dominance of passive flows, there really is no upper limit on the valuation that the market will ascribe to a growing, quality businesses like Energy One.

I also prefer Southern Cross Electrical to Genus because it has exposure to data centres as well as renewables. It is also cheaper, with a forward PE of 13 versus 17 for Genus according to Stockopedia and pays a bigger dividend (5% forward yield versus 1% for Genus).

Buying Nanosonics

I bought Nanosonics with the proceeds of my Genus sale. Nanosonics recently reported 18% constant currency revenue growth for the first half of FY25 and upgraded guidance.

I was particularly impressed with progress in Europe which saw a 37% increase in revenue to A$5.9 million. This compares favourably with UK listed competitor, Tristel, which posted 9% constant currency revenue growth to £22.6 million for the same period. Tristel currently generates over 80% of its revenue from Europe.

This anecdote left by a reader of Maynard Paton’s excellent blog provides a further hint that Nanosonics might be muscling in on its smaller peer:

Tristel has recently entered the US market where Nanosonics currently dominates. According to management, “the sales process is taking longer than initially anticipated” and the company generated just £37 thousand of royalty income from the territory in the first half. A recent change in leadership at Tristel adds to the uncertainty.

Other competition includes Chronos devices which use UV light rather than chemicals to disinfect and gained FDA approval last year. Chronos has been available in Australia since December 2020, but this has not prevented Nanosonics from increasing its installed base from 1,660 to 2,210 in APAC (predominantly Australia) since then. Consumables revenue has risen from A$1.9 million to A$2.5 million in the region over the same period. This is despite Nanosonics starting with a claimed 70%+ market share.

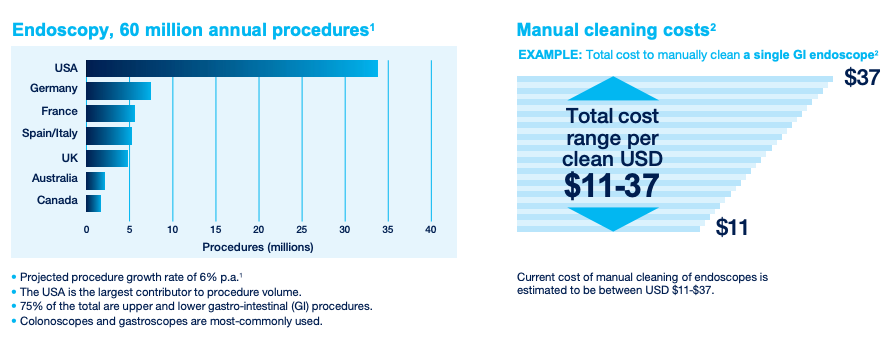

Nanosonics has been long developing a second device to complement its Trophon ultrasound disinfector called Coris. In last week’s half yearly report we were told that commercialisation of Coris is slated for Q1 FY26 assuming successful FDA de novo clearance. Nanosonics thinks that the potential market for the endoscope cleaning device is similar to that of Trophon.

The cost of developing Coris has suppressed group earnings over recent years, but management now separately discloses the performance of the Trophon only business. It generated A$23.4 million of EBIT in the most recent half, up 43% on the prior year. This is more than double revenue growth of 18% indicating strong operating leverage.

Given a growing market, high barriers to entry due to both regulation and a large installed base, and fairly benign competition, I think the Trophon business can keep growing strongly for a while yet.

If we adjust Nanosonics A$1.4 billion market cap for its ~A$150 million in cash and assume a Trophon only EBIT run-rate of A$50 million then we get an EV/EBIT of 25 with Coris thrown in for free. This strikes me as reasonable, and if Nanosonics can reclaim its market darling status then index flows should do the rest.